Adverse credit can be easy to fall into. Your circumstances could unexpectedly change, leaving you struggling to keep up with monthly repayments for any credit or loans you might have. Before you know it, your credit score has taken a nosedive, and these missed payments are on your credit file. Having poor credit can leave you guilty and ashamed, but it’s more common than you might think, affecting 8.4 million people in the UK in the last three years*.

If you have adverse credit, you might think there’s no hope of achieving your homeownership dreams. Whether you’re a first-time buyer, remortgaging, or looking to upsize, getting a mortgage with bad credit is possible.

How Does Your Credit History Affect You Getting A Mortgage?

For most, a mortgage is the biggest loan they’ll ever take out. This comes with a risk for mortgage lenders, and they need to be convinced that you can meet the monthly repayments and that they will eventually get the money back.

When you apply for a mortgage, the lender will want to see your pay slips, P60, bank statements, evidence of savings, proof of deposit, and SA302 forms if you’re self-employed. They also look at your credit history to see how good you’ve been at paying off debts previously. Every lender has different criteria, but if you’ve missed repayments in the past, have too much outstanding credit, or apply for new credit frequently, you might be seen as a risk, making getting a mortgage harder.

What Is Bad Credit?

Not all credit is bad. It’s good to have a credit history that shows that you borrow money and pay it back each month. It’s important to remember that any committed monthly repayments you have, like a car on finance, for example, will be seen as committed spending that has to be deducted from your income, which could impact affordability.

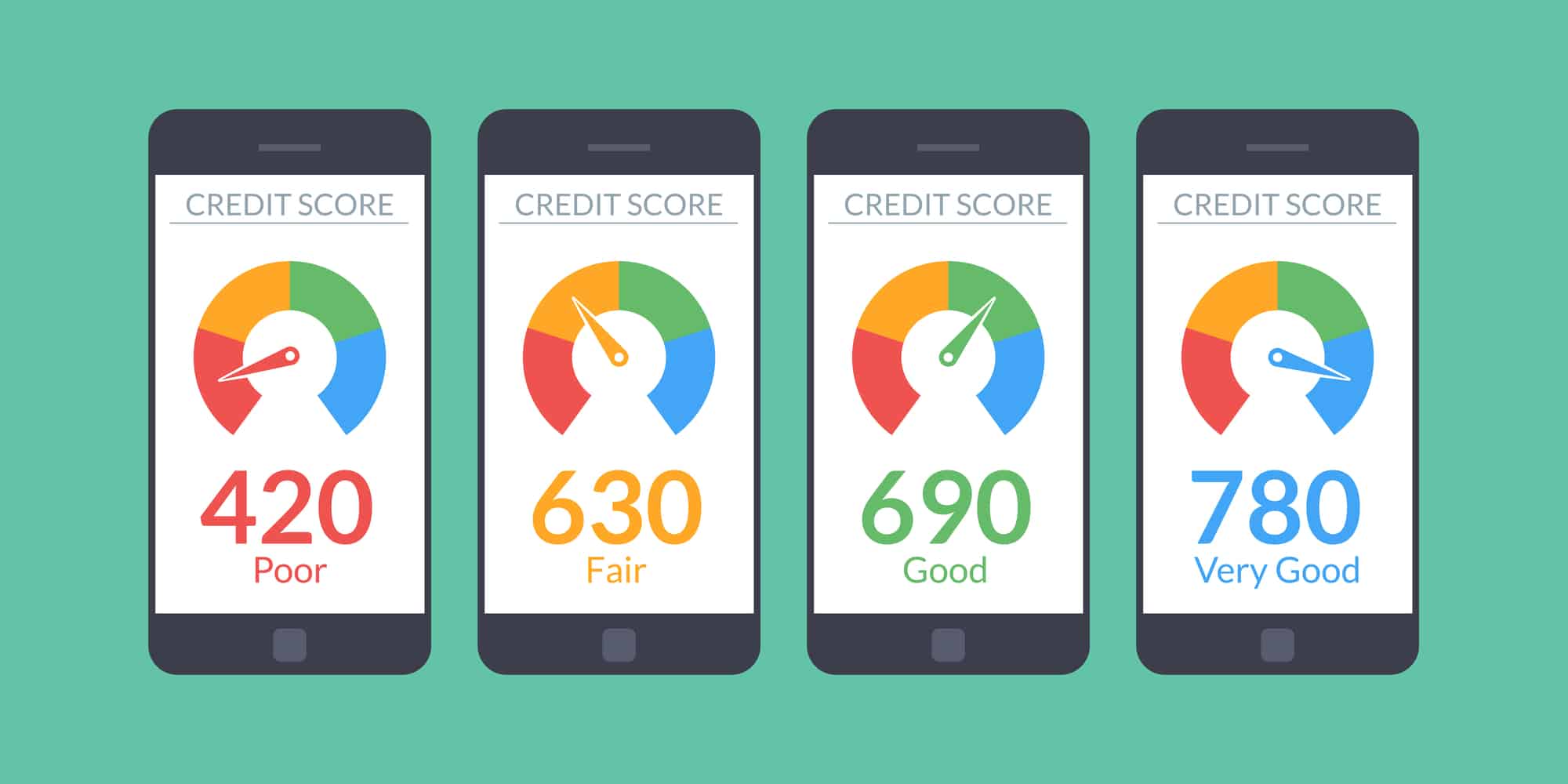

Having adverse or bad credit means that you have a low credit score. This can happen if you:

- Have missed loan or credit card repayments

- Don’t pay bills on time

- Have a high amount of debt

- Have been declared insolvent through bankruptcy, an Individual Voluntary Agreement, or a Debt Relief Order

- Have been served a County Court Judgement (CCJ)

Why Does Bad Credit Make Getting A Mortgage More Difficult?

It’s very easy to fall into bad credit without meaning to. Anything related to bad credit stays on your credit file for around six years, and it can put high street lenders off, but it’s not the end of the world.

If your bad credit is related to relatively small amounts in the tens or hundreds of pounds, this shouldn’t prevent you from getting a mortgage offer. Problems can occur when your bad credit is in the thousands, which usually makes a high street lender say no. However, there are specialist lenders out there who can help.

Having bad credit can make the mortgage application process much longer, as lenders will want to see more information about your financial situation to get a clearer picture of your finances before agreeing to lend money to you.

Mortgage Tips When You Have Bad Credit

If you have bad credit and want to get a mortgage, you should still be able to get one if you know where to look. There are specialist bad credit mortgage lenders who will lend to you if you have poor credit.

However, having bad credit doesn’t come without its drawbacks. To secure the loan amount, you will likely have to provide a larger deposit; the available interest rates are higher, which might affect how much you can borrow. For example, some lenders may only be willing to lend four times your income instead of six times if you have bad credit.

Going down the bad credit mortgage route can be the perfect stepping stone for allowing you to achieve home ownership. After your initial fixed term has ended, you may be able to move to a more favourable mortgage product.

Paying off existing debts and meeting all your payment deadlines can help boost your chances of getting a mortgage.

What Happens If I Have No Credit History?

You might be surprised to learn that having no credit history can also be damaging if you want to secure a mortgage. This is a common predicament that many medical professionals who have come straight out of university or foreign nationals who have come to work in the UK face.

Having no credit means you have no record of borrowing and paying back money, so lenders can’t guarantee your ability to repay a mortgage. In the meantime, taking out a credit card for small monthly expenses can be a good idea, as it ensures you pay it off in full each month to help you build a credit history.

Our Team Can Help

Whether you are a doctor with bad credit or no credit, the team here at Doctors Mortgages Online can help you reach your homeownership goals thanks to our connections with specialist lenders who understand your unique circumstances. Contact us today to find out more.

*Source: Pepper Money Specialist Lending Study.