Whatever the reasons for your second home purchase – be it a home for the kids at Uni, your little place in the country or a buy-to-let investment – if you’ve been toying with the idea of investing in property, you’d better get your skates if you want to know how to beat the stamp duty surge on second homes!

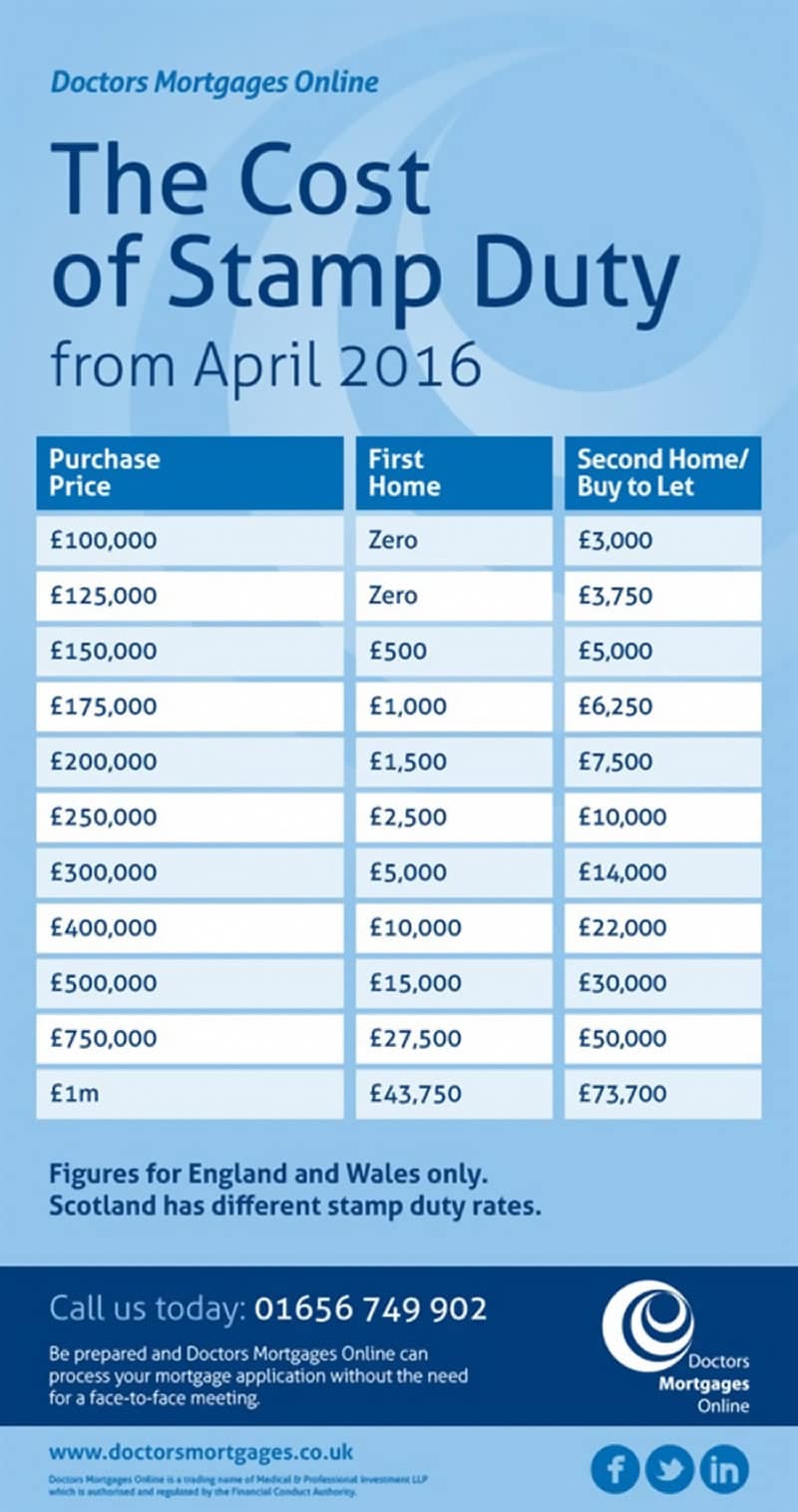

From April 5th 2016, stamp duty on buy-to-let or second home property will increase by 3%, meaning that the charge on a £175k property will jump six-fold from £1k to £6,250. If you are looking to buy a £400k flat in London, you will have to pay £22k in tax, as opposed to the current £10k. That’s quite a difference!

The current stamp duty taxes mean that you don’t pay any tax on properties up to the value of £125k, then stamp duty is charged at 2% on property purchased between £125k to £250k. Above £250k you pay 5%, and above £925k you pay 10%. The new figures adhere to the current banding prices, but add 3% on top if you’re are buying a property to let or a second home.

So, is there any way you can avoid paying the additional stamp duty taxes, depending on your individual circumstances?

Buying a property for your kids to live in

Buying a property for your kids to live in

If you are looking to get your children on the property ladder or provide them with decent student digs, then unfortunately you will be stung by the new charges if you purchase the property on their behalf, post April.

The only way you can avoid being stung by the changes is to buy the property solely in the child’s name. Your name cannot feature on the deeds. If it does you will face the higher rate penalty.

Taking rental income from shared tenants also has increased tax implications from 2017, so it it is worth making the stamp duty tax saving if you are looking to buy anytime soon. If you weren’t expecting to make the purchase this early, then remortgaging your primary residence is an effective way to free up a deposit in time.

Buying a UK holiday home

If you buy a second property you will always have to pay the higher rate of stamp duty, even if you plan to live in it and rent out your old one.

If you keep your old home at the time of completion you will need to pay the extra stamp duty charges, even if you move into a new main residence.

The only leeway is that you can get a refund of the stamp duty if you sell your old property within 18 months. This aims to help those who may hit delays in the selling process.

You will need to apply for the stamp duty refund through HMRC.

Buy-To-Let investing

Increasing house prices, especially in London and the Home Counties have made buy-to-let investing an attractive option for doctors. They are a great way for doctors to secure an interest-only mortgage and earn an additional income. An increase in stamp duty puts a dampener on anyone looking to invest in additional property, so it is worth adding to or creating a portfolio sooner rather than later.

Buying in a partnership

Married couples and civil partnerships will act as a single unit when it comes to the eligibility criteria. If either individual owns more than one property, then the other will pay the increased stamp duty, even if they are the sole buyer.

If the initial property was sold on within 18 months of the purchase of the second home, then you would be able to claim a refund from HMRC on the grounds that the new property is becoming your primary residence. This rule could also be extended to cohabiters.

Buying if you own a home abroad

If you already own a property overseas then this will be a factor in the stamp duty you pay on an additional UK property purchases. If you don’t already own a property in the UK, but you have a property abroad and are looking to purchase in Wales, England or Ireland then you will have to pay the increased stamp duty rate after the 5th April. Scotland has its own stamp duty tax in the form of Land and Buildings Transaction Tax (LBTT).